Recoverable and Non-Recoverable Draws

A commission draw allows employees to withdraw from future commissions to maintain a regular income. Depending on the organization's compensation plan and pay philosophy, a commission draw may be recoverable (it must be paid back) or non-recoverable (it does not need to be paid back).

Let's explore recoverable and non-recoverable commissions draw in more detail.

What is a recoverable draw?

A recoverable draw is a form of pay advance given to employees against future commissions or bonuses, which the employer can recover from future earnings. It allows employees to withdraw from their future commission earnings and maintain a more reliable income month-to-month.

Recoverable draws are often used in industries with variable compensation structures to provide steady income to employees while still incentivizing high performance. They can be a helpful tool for both employers and employees, as they provide a way to balance the need for a stable income with the desire for performance-based pay.

There are no set terms for recoverable draws. These are determined by the employer and laid out in the employee's contract.

Recoverable Draw Example

Our employee, Xu, is entitled to a recoverable draw of $1,000 per commission period to help her maintain a minimum salary of $7000 a month. Xu earns $1,000 in commissions during that period and uses their full draw amount of $1,000 to take a total variable compensation payment of $2,000 on top of her base salary of $5000.

In the next period, Xu still doesn't reach her full quota and only earns $1,500 in commissions, but only takes out an additional $500 draw on her commissions. She now owes her company $1500.

The following month, Xu does well and collects $3000 in commissions. To keep her paycheck stable, her employer only collects $1000, keeping her take-home pay at $7000—the remaining $500 in the next possible pay period.

In month four, Xu earns $3,000 in sales commission again, repays the balance drawn from the previous periods, and still takes home $7500.

What is a non-recoverable draw?

A non-recoverable draw is a payment given to a sales rep that the employer cannot or does not recover. Think of it as a guaranteed commission payment or minimum wage.

If the total commission the employee earns that month is less than the draw amount, they are paid the difference. If the commission they earn that month is higher than the draw minimum, they receive it all but no draw.

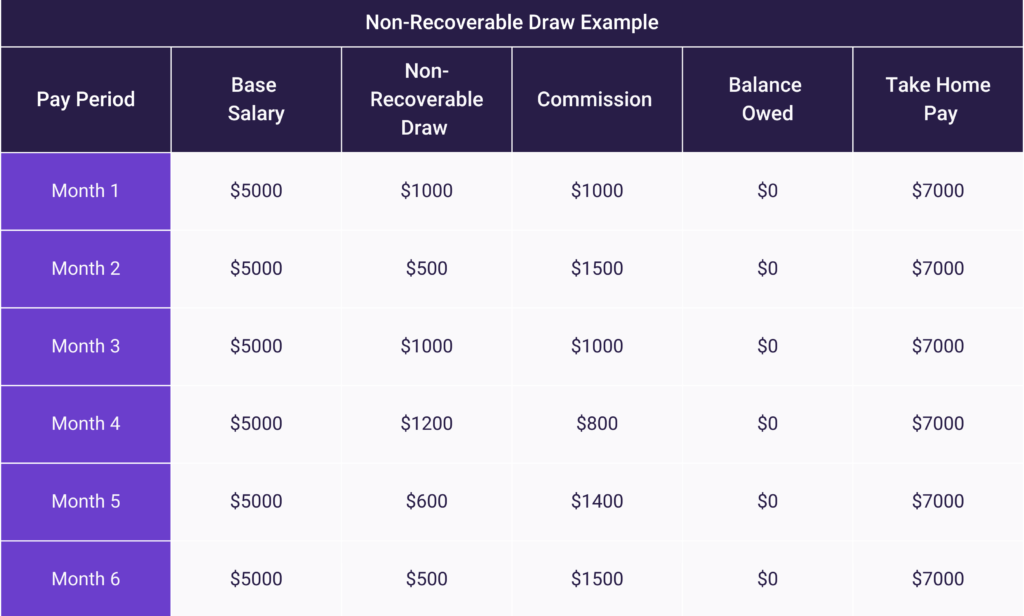

Non-Recoverable Draw Example

For example, if the non-recoverable draw minimum for employee Ying is set at $2000 and Ying's commission that month is only $1,000, they will still be paid $2000.

If Ying makes $2000 in commission next month, they will be paid the full $2000 in commission but nothing from the draw.

Why do companies offer commission draws?

The path to becoming a successful B2B sales employee is paved with challenges. The average ramp time for an Account Executive is 4.9 months. It can take up to three years for a sales representative to reach peak performance, especially for businesses with long sales cycles.

Employers often subsidize the base salary of commission-based employees with commission draws. That ensures sales reps are paid fairly for their time and can continue their standard of living even if sales don't go to plan, or it takes them a while to get ramped up.

A good sales compensation plan must motivate and support sales reps while providing a stable income. Draws are one of the ways employers can provide that stability.

Non-recoverable draws have several benefits.

- Both types of draw guarantee that salespeople will receive certain financial resources to cover their living expenses. Even though recoverable draws have to be returned, they act as an interest-free loan that can be repaid when they earn a sufficient commission.

- New sales employees might need time to generate revenue. Non-recoverable draws help sales employees cover living expenses until they earn sufficient commission to meet their expected On-Target Earnings (OTE).

- In some industries or markets, sales cycles can be more than 12 months long, and non-recoverable draws can help sales employees sustain themselves financially.

- Non-recoverable draws are helpful when business and sales activity are affected due to economic events, a recession, strikes, or disasters.

Do you pay tax on recoverable draws?

Employers provide recoverable draws as a loan that has to be returned. Draws that have been returned might not be taxable. However, non-recoverable draws which the employee keeps might constitute taxable income.

Do employees have to return recoverable draws if they leave?

Recoverable draws are essentially interest-free loans of future commission payments, which employees need to return. However, due to insufficient funds or other circumstances, some employees might not be able to return their recoverable draws. Employers should draft contracts that clearly explain the compensation structure and financial obligations of employees, and what protocol to take should an employee be unable to repay a draw.

Related article: A Simple Guide to Sales Commission Structures

If employees quit without reimbursing their employer, employers can legally recover draws if the law in their jurisdiction allows them to do so.

For example, in California, payments made by an employer to an employee constitute wages and cannot be recovered especially if the employment has ended. An employee's future income can be deducted in California, but past payments cannot be recovered.

Even if employers have legal recourse, it might not be effective as the sales person might not have sufficient financial resources. Also, pursuing legal action might affect reputation and employee morale. Companies may accept the cost and allow departing employees to keep the money.

Recoverable Draws Make Variable Income More Secure

57% of sales representatives might miss their annual sales target, and draws can help employees cover living expenses if sales don't go to plan, providing them with similar financial security to a fixed-salary employee.

%20Measure%20Sales%20Comp%20Plan%20Effectiveness%20in%202024.png)